Hello, my name is Robert Reynolds Bentz Junior, but everyone knows me better as Bobby Bentz. Mom started calling me Bobby at birth and it has stuck ever since. I figured it would be best for me to write this “About Me” story rather than to have someone else write it in a third person version. Let it be known that I am absolutely the one and only who writes everything on this website.

I started working hands-on at a very young age in life. At 12 years old I knew I would want my own car when I turned 15 so I started working for my father, Robert Bentz Senior, at his company called Bentz-Craft Boats. There, I must say, is where my absolute love for business knowledge began. Dad made me start at the bottom and work my way up, absolutely nothing was given to me. While working and making $3.15 an hour, he taught not just how to build boats but about advertising, marketing, material cost, labor cost, knowing the numbers behind running a business, management skills, handling employees, hard work and having pride and integrity in your craftsmanship. Now that goes for everything, if you’re building boats or building an empire. I admired my dad’s hard work, his constant thirst for knowledge in business as I would always see him reading books, magazines and learning all he could to run his own business better and just for his own curiosity as well I’m sure. Unfortunately at times his business struggled severely financially as the boat building industry is extremely competitive and you need big money to properly market your business. All of the Bentz-Craft boats were custom made per each customer so it was mostly seasonal. Everyone wanted a boat when it was summer time and no one thought of owning a boat in the winter. He even had one guy as a business partner for a while who just ended up using my fathers business credit and reputation just to rack up a lot of debt just to flee the country when it all came to light. So during the times I wasn’t working for my father, I worked in restaurants, retail, sales, electrical contracting, and residential, commercial & industrial construction. It was a lot of hard work and now looking back I noticed that a lot of the jobs I did have, I seemed to end up in a more management position. I’m sure I got that leadership skill from my father. Unfortunately he passed on Tuesday, December 2, 2014. He is missed dearly, he was my business mentor.

I also learned the importance of hard work and life lessons from my step father Eddie McCormack. You see, my parents divorced when I was one year old and both remarried when I was three. So I was raised by my mother mainly as I lived with her fulltime and only saw my dad (Robert) every other weekend and stepdad Eddie on the other weekends as he was always working out of state somewhere for his welding career. Eddie, while enjoying his retirement now, has traveled all over the world as a hard working welder, foreman over large projects and operating large robotic welders. I enjoyed learning work and life from both my dads. I must say my mother, Pam McCormack, had quite the task of raising me full time. I know she raised me with love and has always supported me in everything and is such a wonderful grandmother.

At the age of 26 I got married at 27 my first daughter Ava was born. Three years later my daughter Macy was born. Though my first marriage did not work out, I am now in a happy marriage to my beautiful amazing wife named Lorie Bentz. We were joined in holy matrimony on November 12, 2016. She is the absolute love of my life, my best friend, my heart and my biggest cheerleader. Without my wife’s full support and love, none of this would be possible. In case you have wondered what the name LorCo means, it is a short nickname in absolute honor and respect of my wife Lorie. It stands for “Lorie’s Company”. So anyone that knows my love for my wife, knows my love for my hedge fund. I am blessed to be a stepdad myself to two amazing young men, Frankie and Lex.

Throughout my mid twenties until now, I have run a few companies as well. I love being self-employed. That’s my entrepreneurial spirit. I could ramble on forever about what happened in my life but I should maybe save that for a book in the future. I know you’d rather read about my “making of a hedge fund” manager story, so here we go. I didn’t grow up with cable television, and never watched it until one of my old roommates got it turned on and wow, a bunch of new channels I never knew existed. I was 21 years old when I first saw CNBC where they give news on the financial markets. A television station that only talks about business and money. I loved it! I was instantly hooked on the channel and have watched it ever since. And then there were the numbers, those little stock tickers and prices that scrolled across the screen at the bottom. Over the years I have developed a fast eye for the scrolling tickers. Now I personally do not make trade decisions from the news but I still love watching just about everything on the show and you know everyone loves Shark Tank.

I fell in love with the stock market. Ever since early in high school, I loved to figure out problems with numbers and the stock market was this mystical new thing that I had to know more about. I was interested in the commodities market but it just didn’t speak to me like the stock market does. Stock price fluctuation, volatility, quarterly earnings, and those beautiful colorful charts. I was in business heaven.

At the young age of 26, I started an online retail trading account and purchased my first shares of stock. I was hooked. At that moment I knew this was my future. I remember one trade I made where the price spiked after the close and the market opened the next morning and I sold making a quick $800 profit. My passion quickly grew from wanting to just trade stocks for myself to trading for investors as well. It was when I knew this was the career for me. I wanted to help people make smart investments and returns that would help change their lives. To put investors’ money together into one trading account and execute trades that would benefit everyone involved. I wanted to build my own hedge fund but guess what, I had no idea it was called a hedge fund until 2014 while I was working at Google and during my 21 months working there, I finally learned that quirky word, Hedge Fund. So I dove in learning everything I could on every hedge fund out there, along with the good and the bad. For the most part, news media outlets love to trash talk about hedge funds. My absolute dream job was looked down upon by so many people. My research showed me that there were very good reasons for a lot of that bad press as well though. There were hedge fund managers that have been involved in theft, greed, spending their investors money on their own luxury lifestyles, ponzi schemes and imprisonment. It’s those stories that you see in the news, you want to see them reporting all of the positive things that come from the good hedge funds out there. Such as great employment opportunities, building up the local economies, moving markets, all the charitable donations from these good funds and bringing in positive returns for their investors. I knew that my hedge fund would have to be completely different from all those bad apples that have flooded news. My research began. I’ve read all the books, seen the youtube videos, movies, audiobooks, news outlets and I’m still learning about all of the ways that the traditional hedge funds have done things wrong. Whether that’s illegal actions or just the absolute poor choices that the fund managers have made where they have lost their investors millions of dollars to losses in the billions of dollars. These actions have been rooted as the human nature that everyone knows. Greed! Greed has caused so many investment funds to close shop over the decades since the very first hedge fund was created in 1949. So trading with a fiduciary responsibility is an absolute must. So no greed and having an extremely strict risk management platform setup in place is crucial to any successful business. A hedge fund should be treated as such, a business with a plan with steps for preserving capital, creating more capital and to stay completely transparent with all investors involved.

I wanted to take all of the bad news and negative things that other hedge fund investors have expressed that they don’t like since the beginning of the industry and do the exact opposite. Will other fund managers with the traditional standards appreciate what I’m doing? Probably not, but my fund is for the individual and institutional investors that are ready for a change in the industry. So I’m the man that’s making that change.

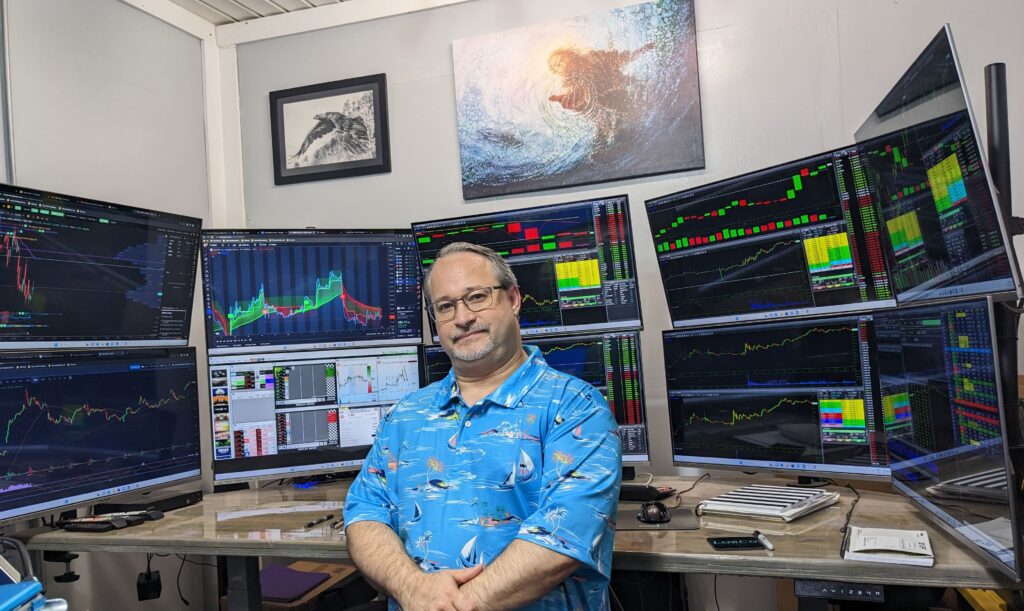

For starters, have you ever been to any other hedge fund or investment companies website where the fund manager is writing his own “About Me” page? Or one that has a blog where you can read and get to know your fund manager who would be over all of the investments on a day to day basis. How about knowing his direct cell phone number and email so you can contact him at any time. Or even send a text message. I make myself available to all who want to learn more about me or the fund, book a call or a virtual meeting with me and let you set the time. I built this website myself. Ever notice how other financial websites use stock photographs on their pages, well every picture on this website is 100% my own and taken either by me, my wife Lorie or someone else close to me or a photographer paid by me. So you know that I am already showing you the real me and what’s at LorCo Capital, LLC. and our hedge fund named LorCo Fund, LP.

Let’s discuss the fees, every hedge fund known to man charges annual fees for the amount of each investor’s (AUM) Assets Under Management. The industry’s standard funds charge 2% annually but there are funds that charge as low as 1% and then some as high as 5% in fees. Well, I am not charging any management fees in the fund. Yes, I will repeat, there are no management fees in the fund, no matter how much or little the investors account size. No Fees. I was raised to work hard for what you earn in this life. Nothing comes easy and you have to work for what you earn. I created my own model for making money from managing the fund. It is after the investors make a profit first and only that way, no acceptances.

Your average interest rate for a banking checking account is 0.04% to 0.10% annually and you might find a little higher rate here and now but those numbers are horrible. Your 10 year rate of return on a retirement 401K can be between 8% to 10%. That is in 10 years. Horrible returns. While in the hedge fund industry, annual returns to the investors have ranged from 10% on up. Depending on how good your fund manager is and of course that is after they take the upfront management fees. Well our investors are enjoying an annual 8% Hurdle Rate. That means that each investor gets 8% of their total AUM annually before LorCo Capital, LLC makes any money at all. No other hedge fund offers this high of a hurdle rate. I have seen as high as a 6% hurdle rate, but never an 8%.

You may ask how do I make any money by managing this fund? By splitting all the returns with the investors after the 8% hurdle rate is met. From 9% and up in the funds annual returns, we split the capital gains 50/50. 50% to investors, 50% to the management company. Now that is not an industry standard at all. Traditional funds are mostly at 2 and 20 (2% management fee and 20% performance fees). With sharing in all losses and gains as 20% to the management company and 80% to the investors. The fees are there whether the fund is performing or not. Those same fees cover the employee expenses, software, equipment, and the list goes on. With LorCo Capital, we cover our own expenses and overhead. Remember, I believe in earning my money. Providing returns to my investors and building an amazing investment company people can trust and rely on at the same time.

Are you ready for some more good news? Traditional hedge funds have always had lockup periods from 1 year, 2 year and on up to several years before an investor can make a redemption of their capital investment in the fund. Now this doesn’t stop the investors annual return of capital gains made, it just locks up their initial investment into the fund. Well if the whole Covid 19 time and other things that can pop up in life have taught us anything, is that sometimes people may need to make redemptions on their money. So in that aspect, I have decided to not have any lockups on any investors’ capital. They are able to make redemptions without any fees or penalties. Now of course I’m not running a bank here. I don’t want any investors to submit early redemptions and pull their capital, but I want to offer it to my investors because no one else does. Not in a hedge fund. Since our trades are short term, that gives us the ability to be able to allow no lockup periods.

If you are ready to take the next step and learn more about becoming an investor in our hedge fund, please contact me by clicking HERE or book a time to talk to me in a Zoom Meeting.